is a car an asset for medicaid

Seek Help With Medicaid Application And Spend. What you can and cant keep with Medicaid.

Potential Changes To Medicaid Long Term Care Spousal Impoverishment Rules States Plans And Implications For Commun Medicaid Long Term Care Family Foundations

Some assets are exempt which means they do not count towards the asset limit.

. In general the following are the primary exempt assets. Medicaid is a healthcare program that is provided and financed. Discuss Medicaids Personal Service Contract and the purchase of a new car to avoid Medicaids spend down rules.

A financed vehicle can be considered an asset but only if its value is greater than the amount you. A kelly-blue-book value that will keep our total assets under the 3000 limit for couples in our state in order to keep medicaid. Every other number minus the one non-countable asset is regarded as a countable asset and will be taken into account to sell off and pay any healthcare debt that you might be.

Yes buying a car while on Medicaid will affect your Medicaid because you would be questioned on how you get the money to buy the car. One car according to the policies of the program is a non-countable asset that will not be taken into the account of Medicaid while taking stock of your countable assets. More about the medically needy pathway.

401Ks and IRAs in some states may be considered an asset or count as income. It will depend on the circumstances on how such a transaction is treated in your state and perhaps on the particular intake worker. You can own an automobile and qualify for Medicaid.

Additional vehicles boats and RVs. Cash in the amount of 2000. An amount is calculated to decide how much the applicants co-pay or spend.

Used car prices ie. Any cash savings investments and property that exceed these limits are. This implies that Medicaid insurance will not count some assets in its checklist to see if the Medicaid applicant qualifies.

The Medicaid numbers used in this post are those in effect in February of 2022. Life Care Agreements. So this is one of the quirks in the Medicaid Program that they will allow you to have one car and they don.

Medicaidplanner Staff answered 2 years ago. When it comes to listing a companys assets on a balance sheet. My state doesnt consider the first car as an asset but the equity of the second one is.

When a Medicaid client owns a vehicle which does not fall into one of the five exemption categories listed above the vehicle is considered an asset of the clients estate. SSI sets the standard. Exempt assets are those which Medicaid will not take into account when a person applies for Medicaid benefits.

An applicant must have assets also called resources under a certain amount to qualify for Medicaid. MAGI Medicaid does not cover everything. Each state has separate Medicaid rules regarding countable assets and what is Medicaid excluded assets.

This is a period of 60-months 30-months in California that dates back from. If your spouse minor or special-needs child is living there it is automatically exempt. This means you can own one Bentley worth over 100000 and that vehicle would not be.

1 877 21-Medicaid or. While the Medicaid rules themselves are complicated and tricky its safe to say that a single person will qualify for Medicaid if she. This is a very good question and I see it come up frequently and the short answer is yes you can own one automobile regardless of value generally and qualify for Medicaid as long as this is the automobile you use for your personal use.

CDs bonds stocks special trusts. In 2021 the income limit is set at 2382 per month and the asset limits at 2000 for an individual. At the federal level Medicaid applicants can make no more than 2382 per month and may possess no more than 2000 in stocks bonds and other liquid assets in order to qualify for Medicaid.

Generally a single Medicaid applicant who is 65 or older may keep up to 2000 in countable assets to qualify financially. Call us for a free intial consultation today and potentially save 100000 or more in nursing home costs. Each state has separate Medicaid rules regarding countable assets and what is Medicaid excluded assets.

If you enter a nursing home with the intent to return home and your home is under the equity limits it will not count against your assets. Each state has separate Medicaid rules regarding countable assets and what is Medicaid excluded assets. If your income and assets are above a certain level you will not qualify for the program.

Your home may be exempt. Or replacing old tires are also a way to spend down assets as is selling an existing car at fair market value and purchasing a new one. On the business side something is considered an asset if it holds value and can help sustain a companys operation and growth.

The applicants principal place of living is an excluded. Rules and Regulations for Medicaid and Car Ownership. Exempt assets will not be counted when determining your eligibility for Medicaid.

The following is a list of exempted resources in assessing a Medicaid applicants eligibility for Medicaid nursing home services. For example if you have a car that is worth 10000 and you owe 5000 on it the value of the asset as a whole would be 5000. This wouldnt have been as hard 2-3 years ago.

Any value over 4500 is counted toward the 2000 total assets limitation. According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value. Before learning how to spend down to qualify for Medicaid you need to know the rules about how the state penalizes the gifting away of assets.

The effect of this rule is that the client may be required to sell the automobile and purchase. I am not sure but a leased car is not an asset and cannot be sold so Medicaid should not care as long as his money is not being used to pay for it. When the goal is an equitable distribution its crucial you have an accurate value.

Medicaid is a very complex government program. In the past a vehicle was exempt only up to a value of 4500 but this no longer holds true. Unfortunately this is one of those gray areas where the answer depends on whether you can convince the Medicaid intake worker that the gift to your daughter was not for Medicaid planning purposes.

Medicaid also considers many assets to be exempt non-countable. A second car truck or mobile home. Under federal regulations one vehicle which in some cases may include a classic car or a luxury car is exempt from Medicaids asset limit regardless of value if specific criteria covered below are met.

And its not even owned. Medicaid determines the appraised value of these assets by factoring in any depreciation or liens. Rules and Regulations for Medicaid and Car Ownership.

A financed vehicle can be considered an asset but only if its value is greater than the amount you owe on it. Medicaid programs consider certain assets to be exempt or non-countable usually up to a specific allowable amount. According to the Florida ESS Policy Manual Section 16400583 and Section 16400591 explain that a single automobile car truck motorcycle etc is excluded as an asset regardless of its value.

Since you shouldnt have more than 2000 to qualify for Medicaid you cant buy a car while on Medicaid to avoid losing your Medicaid coverage. This could even be a Lamborghini. Because cost of living can vary dramatically depending on which state you live in your liquid.

Can I Sell My Car While On Medicaid Yes Or No Automobtips

5 Ways To Protect Your Money From Medicaid Elder Care Direction

Medicaid Spend Down How To Qualify For Medicaid With A High Income

What Assets Are Exempt From Medicaid Plan Right Law

Transferring Assets To Qualify For Medicaid Michigan Law Center

Nursing Home Medicaid Tip Single Or Widowed Case Buy A New Car Law Office Of Glenn A Deig

When It Comes To Estate Planning It Pays To Consider Each And Every Option For Protecting Your Legacy One Of The Be Estate Planning Life Estate Things To Come

Can I Sell My Car While On Medicaid Yes Or No Automobtips

How Do Assets Affect Medicaid Eligibility Richert Quarles

/dotdash-medicaid-vs-chip-understanding-differences-v2-ce78e3fa912a4806a1f58a166cfd649f.jpg)

Medicaid Vs Chip Understanding The Differences

Auto Insurance In Rhode Island In 2022 Car Insurance Best Car Insurance Comprehensive Car Insurance

How To Qualify For Medicaid In Texas Regardless Of Income Holman Law

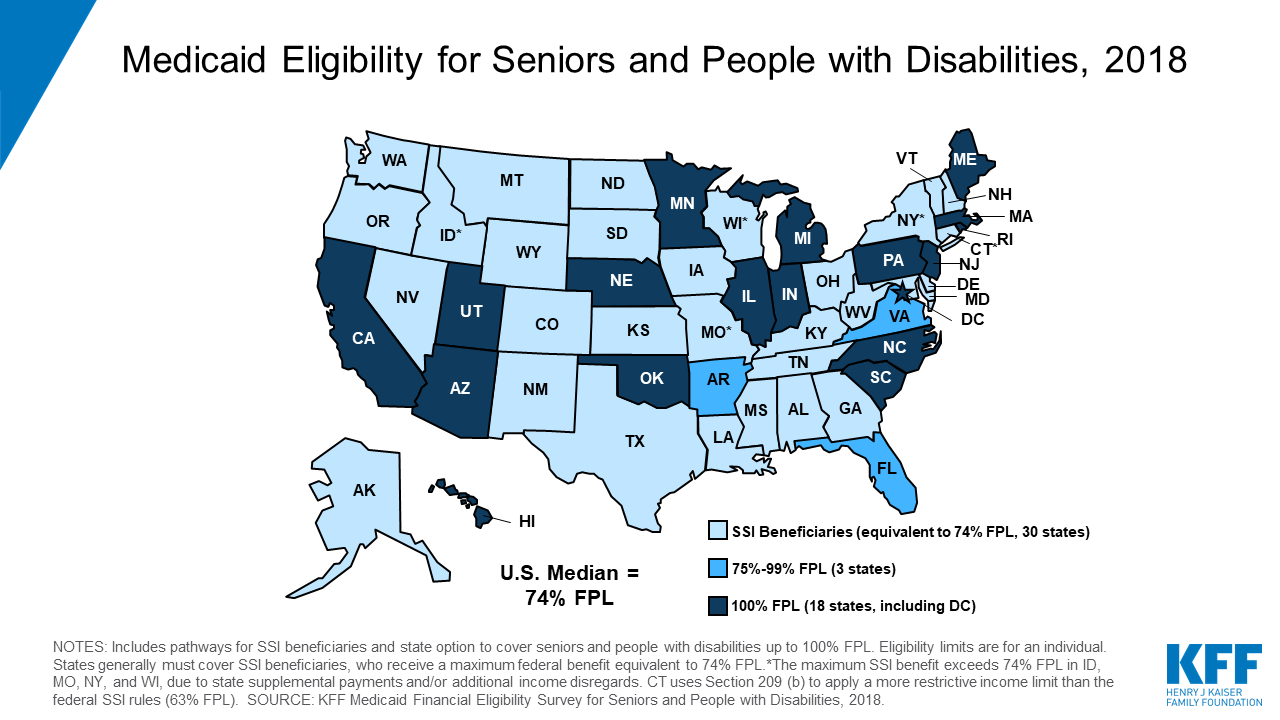

Medicaid Financial Eligibility For Seniors And People With Disabilities Findings From A 50 State Survey Issue Brief 9318 Kff

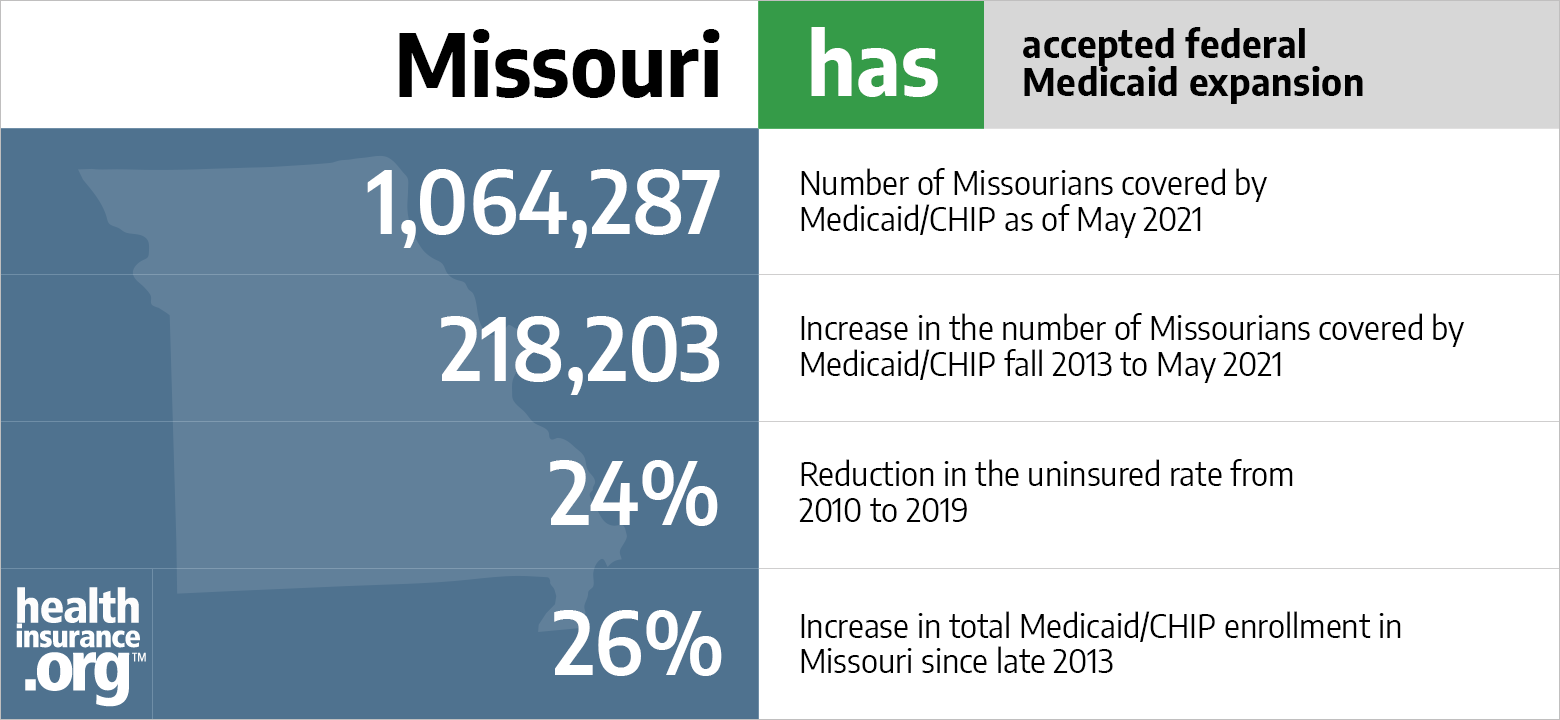

Aca Medicaid Expansion In Missouri Updated 2022 Guide Healthinsurance Org

Medicaid Eligibility Frequently Asked Questions Center For Elder Law Justice

Learn How To Protect Your Assets From Medicaid Freedomcare

Medicaid And Car Ownership What To Know Copilot

Spending Down Assets To Qualify For Medicaid Elder Care Direction